The markets have experienced a number of corrections since the US announcement of punitive tariffs on Chinese imports and the Chinese returning the love with a list of their own.

Is this just a storm in a teacup? The quick answer is NO. If you bear with me, I will explain why nobody truly wins in a trade war.

General points

Here are a few conceptual items to help you see the topic better if you are new to the archaic world of macro economic theory. The hyperlinks will take you to a more detailed write up of the underlying theory.

- In a world where only 2 countries exist, trade tariffs will reduce world trade owing to the impact it has on prices to the consumer causing a general drop in quality of life as a result.

- We do not live in a world that is made up of just the United States and China.

- China isn't the only country exporting the goods the United States are planning to impose tariffs on.

- When you slap a tariff on an import, do expect a response from all affected exporters.

- When a Tariff is put on something like steel, you affect the country exporting it (intended impact); you protect the domestic steel industry (intended impact); you raise the price of raw materials for your industries dependent on the import (Collateral damage). Why? Because a Tariff makes something that was produced at lower cost (read - more efficiently ) artificially expensive so the domestic stuff that is produced at higher cost will look cheaper (note - no efficiency improvement in domestic production)

The Tariff

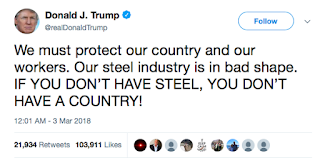

The President of the United States had tweeted the following...

The list of items to be tariffed has grown exponentially since so to get to the point fast, I shall be talking about the steel tariff.

The main exporters of steel to the US are as follows for 2017 (Source: Wood Mackenzie). Note how China is number 10 on the list.

- Canada 16.7

- Brazil 13.2 pct

- South Korea 9.7 pct

- Mexico 9.4 pct

- Russia 8.1 pct

- Turkey 5.6 pct

- Japan 4.9 pct

- Germany 3.7 pct

- Taiwan 3.2 pct

- China 2.9 pct

- India 2.4 pct

Also, a number of countries have secured exemptions to date like Australia, Argentina, Brazil, Canada, South Korea, Mexico and the EU.

America's Trade Profile

|

| US Exports to the world in 2016 (Source: OEC) |

|

| US Imports from the world in 2016 (Source OEC) |

Steel would be a subset of the "Metals" class in the above charts. The US is the world's largest importer where the total value of imports was USD2.21Trillion in 2016.

|

| Countries the US Export to in 2016 (Source: OEC) |

|

| Countries the US Imports from in 2016 (Source: OEC) |

In this chart, you can see that China accounts for a large portion of what the US imports. As you will see, the size of what China imports has very little to do with what they do through steel.

China's Trade Profile

|

| China Exports to the world in 2016 (Source: OEC) |

|

| China Imports from the world in 2016 (Source: OEC) |

China is the world's largest exporter where the total value of exports was USD2.06Trillion in 2016. From the above charts, you can see steel exports are a distant 3rd to their main export of machinery.

|

| Countries China Export to in 2016 (Source:OEC) |

|

| Countries China Imports from in 2016 (Source: OEC) |

In the above charts, you can see what appears to be 22% of what America imports from the world accounts for 19% of what China exports to the world. China imports 10% of what they need from America and this translates to 8.1% of what America exports.

What do the trade profiles show?

The steel and aluminium tariffs aimed at the US - Chinese trade will have direct impact on about

2 to 3% of each country's total trade volume (about USD30 billion). Punitive and or retaliatory tariffs will increase the size of the impact to about USD132billion in exports for the US and USD391.4billion in exports to China based on 2016 trade figures. This worse case scenario assumes both the US and China have applied tariffs to the full range of what is traded between the countries in an all out trade war.

That said, both countries will either have to import from elsewhere and or be slugged by the costs in production. I am in the opinion that it is highly unrealistic to expect consumers and manufacturers to switch where they import from or export overnight to keep their supply costs down. Such costs do eventually get passed on to consumers and manufacturers who exist further down the supply chain culminating in inflationary pressure applied through the supply chain.

Trade war in the context of the real world

With the escalating trade war, the tariffs the two biggest trading nations throw at each other will eventually affect goods and services traded between countries who aren't involved in the trade war.

The source of where the effect of the tariffs could leach to the rest of the world is through the materials; components or ingredients used in the production of goods and services.

However, if both countries abandon their rhetoric and start negotiating, that will be the best outcome for all.

In Conclusion - What do you do?

Inflationary pressures will be a concern to all on the road ahead from the supply side of the economic spectrum.

GDP Growth for the world was 3.7% for 2017 with Asia accounting for the higher growth numbers.

|

| Global GDP growth in 2017 (Source: IMF) |

|

| GDP Growth by Region for 2017 (Source: IMF) |

If aggregate demand isn't strong enough to absorb the fallout of the trade war through supply induced inflation, we are going to be headed for a rough few years while the trade war rages.

The priority for everyone would be to secure your savings and investments against inflation. Investments that track inflation well like the following would be something you want to look into.

- Commodities (There are ETFs for this)

- REITs(Most exchanges list them and they can be traded like stock)

- Inflation tracking Bond ETFs

- Treasury Inflation Protected Securities or "TIPS" If you are in the US, you probably have this option.

I am not in favour of going into stocks of companies that deal with Commodities or Gold for an inflation hedge. The price of the

company stock still moves with the broader equity market during beta expansion events.

Some studies have shown that the S&P500 is also a good hedge to inflation. It is my opinion that the index is not a viable option given where that is right now as a result of

quantitative easing (QE).

Gold is traditionally viewed as an inflation hedge.

Recent studies have shown that the inflation - gold price relationship isn't as clear cut and appears to only work as a hedge in the longer term.

Who is more likely to end up least damaged?

My bet will be on China given their GDP growth numbers to date and the fact that they have the critical mass to power through a recessed global economy like they have done through the GFC of 2007. I imagine

Gary Cohen may have been aware of this.

Charles JD Lim, CAIA