Is a Crisis on the Horizon?

The "Correction"

There has been some concern around the sell-off starting near the close of Feb 2nd. This was after NFP printed 200K for January 2018 - a rise over the previous print of 160Kat the close of 2017.Most of the commentary had been around interest rate expectations. Investors are spooked by how that will impact the bottomline for firms that had been thriving under the QE regime since the end of the last recession.

|

| Normalised (%Change) Charts for DJIA, S&P500 and NADAQ (YCharts) |

In the above chart, we see the %change of the Dow Jones, S&P500 and the NASDAQ around the last 2 recession events.

The Dot.Com bubble is clearly seen in the Nasdaq graph and the GFC (Great Financial Crisis) of 2007 is seen as the broader grey strip.

The recent dip people are concerned about is the little hook on the end of the 3 graphs. Commentators have noted that the recent market drops are market corrections at best. The question however is "Is it the beginning of the end?"

Lets examine the probability of that crystallising.

Economic Indicators

|

| Normalised (%Change) Charts for Key Economic Indicators (YCharts) |

In the above chart, you can see the Building Permits and Housing starts have been traditionally high when it started to nosedive in the lead up to the financial crisis in late 2007. We can now see both indicators to have almost returned to growth levels last seen in the mid-90s. The key leading economic indicators show to be on a recovery footing.

Back to the price action that had gotten people scared.

What happened?

|

| S&P500 Index |

Will Yield Expectations Push Us Off the Cliff?

|

| 10Y UST Yields vs DJI and S&P500 |

That said, we must however note that 10 year yields have been on a downward trajectory since it's peak before the 1987 recession (Black Monday).

Also of note, stock market values have steadily increased throughout this period (1989 - Present). it is also noted that equity value growth had grown at an unprecedented rate since 2009. The question that is left to ask - "Are we seeing a price bubble growing since 2009 in the equity markets?"

My Answer to that is an emphatic "YES"!

The Bubble

let us have a look at the components to the DJIA. |

| DJIA Components with weightage shown |

The above chart implies that the top 10 tickers would drive the value of the index.

|

| Dow Jones Value Growth since 2009 |

Let us look at my favourite ticker - AAPL or Apple.

|

| AAPL Fundamentals Since 2008 (YCharts) |

However so, we would want to look at Apple's risk profile to an interest rate rise.

|

| AAPL with Long Term Debt Obligations and Current Ratio (YCharts) |

The yields where they are at right now is not at a sustainable level in the long run. QE will have to be unwound at some point and interest rates brought to a more sustainable level.

CONCLUSION

There is no immediate danger of the economy falling off the cliff even though there is a pretty established price bubble in the equity markets. So... how did I come to the conclusion of a price bubble?

Here it is.

Companies have been profitable owing partly to the lower cost of funding during QE. As a result, their equity values increase as does the indexes. People start piling into what seem like a great idea to grow their savings through investing in the equity markets pushing equity values ever higher (Think FOMO).

Take the low rate environment away and what happens? Profitability start to thin and people start pulling out their money. In the worst case scenario, it forces a series of market corrections.

I am in the opinion that rates must rise to dampen inflation or we are about to see what happens when an economy is allowed to over heat. That said, it does not take away the fact that yields have trended lower since 1987. The environment with Quantitative Easing thrown in had contributed to the rise of equity values and valuations (Think building a sandcastle on an airbed that is about to have it's air taken out).

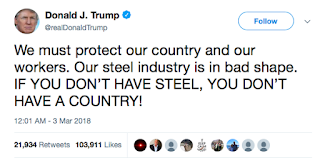

The biggest challenge for the Feds would be to unwind QE with as little damage as possible so as not to shake investor confidence. This administration is all about spurring growth and has a pretty inflationary fiscal line-up.

Will there be a crisis? only if the Feds decide on a QE unwind that is deemed too aggressive.

Will there be a crisis? only if the Feds decide on a QE unwind that is deemed too aggressive.

Charles JD Lim, CAIA